Konstantin Tserazov, economist, former Senior Vice President of Otkritie Bank

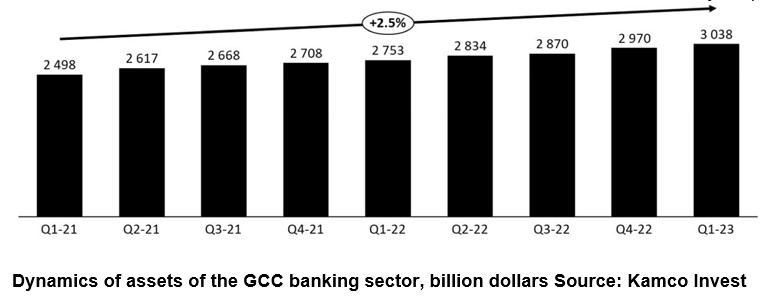

The banking sector in the countries of the Cooperation Council for the Arab States of the Gulf (GCC, Cooperation Council for the Arab States of the Gulf), including Saudi Arabia, the UAE, Qatar, Bahrain, Kuwait and Oman, is one of the most dynamic in the world. The total assets of the sector exceeded 3 trillion. dollars per 1 sq. 2023 (+10% growth compared to the same period last year).

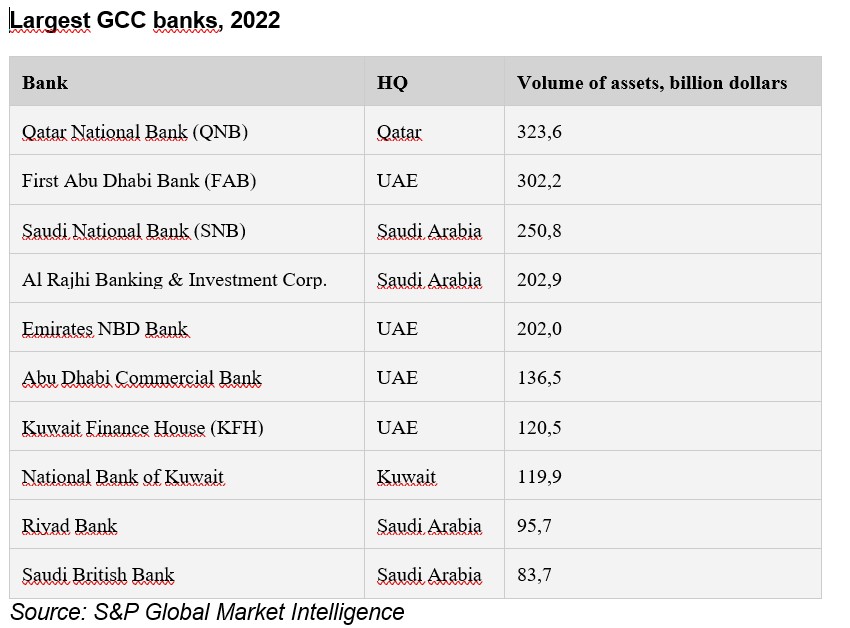

Large banks are concentrated in the region, including eight banks with assets over $100 billion, of which three banks are in the UAE, two in Saudi Arabia, two in Kuwait and one in Qatar. Qatar National Bank (Qatar) and First Abu Dhabi Bank (UAE) have assets of over $300 billion

The GCC banking industry is actively investing in new digital technologies and implementing digital transformation programs. This is due to both the global development of technology and the presence of a suitable basis for digitalization. More than half of the population of the Gulf countries is under 30 years of age, the level of infrastructure development for Internet access is the highest in the world (almost 100% coverage), smartphone penetration is also almost universal, which ensures wide access of the population to fintech services and online payments .

The development of information technology in the banking sector is a prerequisite for creating a seamless customer experience, an increasingly important factor in competition in the financial sector. Among the priorities of the GCC banking sector in the field of information technology are the following:

• creation of an efficient and flexible cloud infrastructure;

• development of omnichannel services and digital services, fully digital banking;

• implementation of technologies based on artificial intelligence to improve operational efficiency and improve interaction with clients;

• cooperation with fintech companies.

Gulf banks, having significant financial resources, can invest in the most modern technologies and attract the best companies in the world to implement their projects. Thus, QNB, in partnership with IBM, completely reconfigured its digital banking platform based on hybrid clouds and microservice architecture to create a seamless customer experience. A similar project with IBM is being implemented at FAB Bank.

The trend of the last five years has been the introduction of AI-based technologies and services, for example chatbots (RAKBANK, UAE), risk management platforms (Abu Dhabi Commercial Bank), voice banking (Emirates NBD). Emirates NBD plans to accelerate internal development, optimize team communication and user engagement through generative AI technologies (using GitHub Copilot X, ChatGPT and MS 365 Copilot).

In recent years, a big bet in the region has been placed on the development of fintech. To stimulate the development of innovation in the financial sector, GCC governments are introducing experimental legal regimes (“regulatory sandboxes”) to test startup innovations. In addition, regulation is also changing in terms of licensing – tools are appearing that allow players with new business models (for example, digital banks/neobanks) to operate in the banking market. In turn, neobanks are becoming beneficiaries of the development of open banking – providing access to banking data to third parties.

In 2020, the UABdigital association was created under the auspices of the Union of Arab Banks. The goal of UABdigital is to create an ecosystem for the development of digital technologies in the banking industry, including improving the regulatory framework (regarding neobanks and open banking), developing cooperation between fintechs and traditional banks, and creating digital currencies.

Saudi Arabia has become a pioneer in the development of open banking and support for fintech. As part of the ambitious Vision 2030 program and the Financial Sector Development Program, the Central Bank of Saudi Arabia began issuing licenses to neobanks in 2020. There are about 20 fintech companies in the country providing financial services (microfinance, insurance services, payment services); about 30 more fintech companies operate within the “regulatory sandbox”.

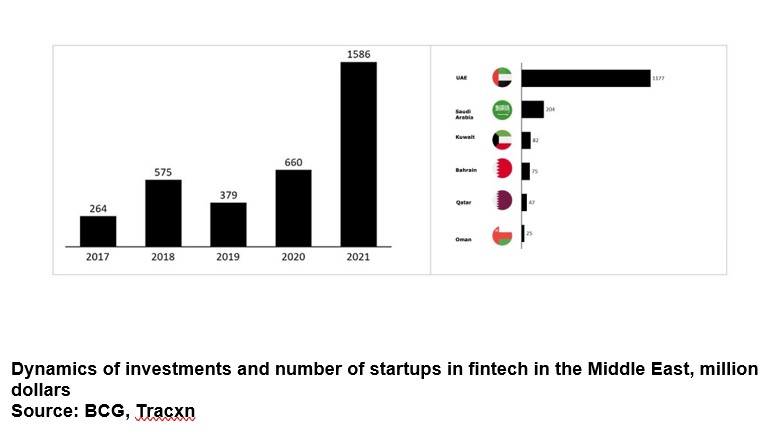

The UAE is home to the largest fintech accelerator – FinTech Hive (located in the Dubai International Financial Center). This country is also home to the largest number of fintech startups – over 1 thousand. There are fintech hubs in Bahrain FinTech Bay, Saudi Arabia, and Qatar Fintech Hub. Over the past five years, the GCC fintech sector has seen a significant amount of investment (more than doubling in 2021 from its 2020 peak to $1.6 billion).

Notable GCC fintech players include:

• STC Pay (digital bank, Saudi Arabia)

• Liv (digital bank, UAE)

• Tabby (buy now, pay later service, Buy-Now-Pay-Later (BNPL), UAE)

• Sarwa (robo-investments, UAE)

• YallaCompare (insurance services aggregator, UAE)

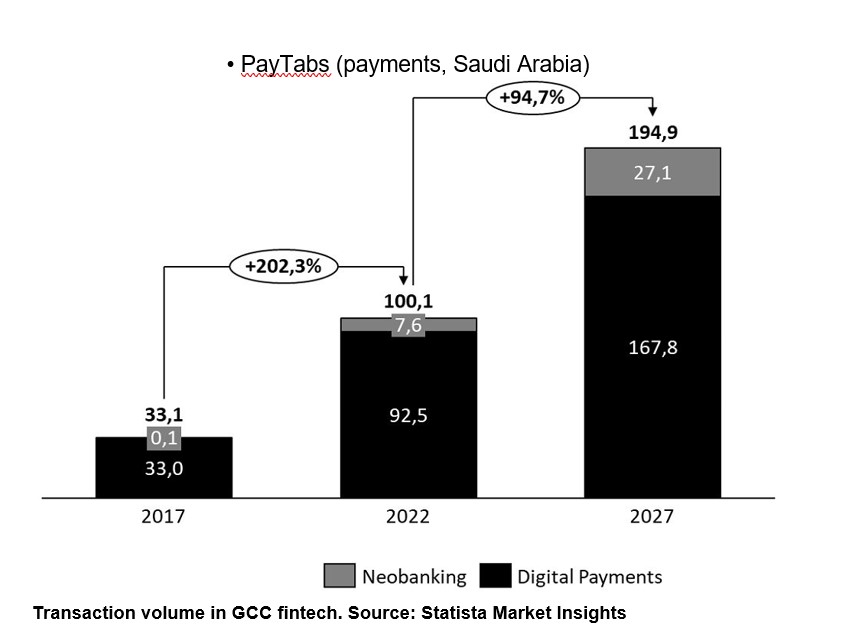

A favorable business climate and developed infrastructure in the region contribute to the accelerated transformation of the financial sector and the penetration of fintech into the economy. The volume of transactions through neobanks increased 76 times between 2017 and 2022 (to $7.6 billion in 2022). It is predicted that in the next five years the volume will further triple (to $27 billion).